In pursuit of a net-zero emissions future, ammonia is seen as an important compound. Ammonia produced from green energy sources serves as an energy storage medium. It is easily transported in liquid form and can be cracked to produce green hydrogen which is a zero-emission fuel. It also can be burned to produce energy without emitting greenhouse gasses (GHGs).

Toyota Looks at Green Ammonia to Power Vehicles

Toyota is the world’s largest maker of automobiles. It developed the first hybrids. (Full disclosure, my current car is a Toyota Venza running on gasoline and lithium-ion batteries.)

Toyota has been a skeptic when putting all its eggs into the electric vehicle (EV) basket. It has had limited success with the Mirai, the first commercial hydrogen fuel cell car. Its vehicle lineup is dominated by internal combustion engine (ICE) cars and trucks that use gasoline and diesel fuels. It also has well-established expertise with hybrid-powered vehicles that combine batteries and small ICE powerplants.

It, therefore, shouldn’t be too surprising for the company to explore new fuel sources for ICE vehicles. With no carbon atoms in ammonia (NH3), using it to fuel vehicles means no carbon emissions. So heavily invested in ICE technology, the company may see green ammonia fuel as a stay of execution. Ammonia-powered vehicles when compared to EVs could be easier to support within the transportation industry and supply chain and, as a result, cheaper to build and maintain. And green ammonia would make these cars as eco-friendly as EVs.

Toyota owns 50% of a Chinese vehicle manufacturer, the GAC Group. This year it launched its first ammonia-powered model, a four-cylinder car that produces 161 horsepower and a very small carbon footprint.

Vehicle challenges using ammonia as fuel include that it is harder to ignite than gasoline or diesel and it burns slower. Pure ammonia requires high boost pressure and compression to compensate for the ignition issue. Blending hydrogen with ammonia corrects the problem.

The Challenge to Produce Green Ammonia

Today, ammonia is produced for industrial uses using the Haber-Bosch process, a method invented early in the 20th century to synthesize the chemical compound using hydrogen and nitrogen. The process uses high pressure (200 to 400 atmospheres) and 400 to 650 Celsius (750 to 1,200 Fahrenheit) temperatures with natural gas, coal or oil providing the heat and the resulting high carbon footprint.

Just how high? According to the International Energy Agency (IEA), direct emissions from ammonia production produce 450 Megatons of CO2 annually with indirect emissions amounting to 170 Megatons. The main sources of these emissions come from the production for use in fertilizers. Compared to steel and cement, that is twice the amount or 2.4 tons of CO2 per ton produced.

To convert ammonia production to make it green means using renewable energy sources to provide sufficient heat and pressure. Siemens is working with the University of Oxford to take electricity produced from wind to do hydrogen electrolysis to synthesize ammonia. The Siemens Green Ammonia Demonstrator at the Rutherford Appleton Laboratory in the United Kingdom uses water electrolysis powered by a wind turbine to extract hydrogen which is then combined with nitrogen from the air to produce ammonia for energy storage.

Creating an Ammonia Distribution Network

The same distribution challenges faced by EVs is one that Toyota’s ammonia-powered cars will face. Where do you fuel up? For EVs, it has involved creating a fast-charging network as pervasive as the current distribution infrastructure that serves gasoline and diesel vehicles.

How large is the fossil fuel distribution network? In the United States today, there are 168,000 stations. In Europe, 140,000. In Canada, 12,000. In China, more than 22,000, Russia, 25,000, Australia, 6,500, the United Kingdom, more than 8,300, and Japan with 29,000.

For ammonia-powered cars, Toyota will have to find room in the fossil-fuel inn to make a go of its venture or face the same challenges that its Mirai model has faced and hydrogen-powered vehicles in general that have attempted to break into the mainstream of the green-vehicle revolution.

The comparison between hydrogen and fossil-fuel infrastructure is stark. At the beginning of this year, the Green Car Congress noted that hydrogen fuel stations had finally surpassed the 1,000 mark globally. In the United States, the number of places to fuel up with hydrogen amounted to less than 100. How can you compete with a hydrogen-fuel-cell-powered vehicle like the Mirai with so few places to fuel up?

]]>

A comparison of CO2 emissions from 100 ICE (gasoline and diesel) and 100 hybrid, plug-in, and battery electric vehicles (EVs) show the carbon footprint differences among them, from how many trees you would need to plant to how many smartphone charges would equal the offset to the emissions produced by these different types of vehicles.

- ICE cars emit 7x more emissions than EVs.

- You’d need to plant 25 trees in a year if you use an ICE car to offset its annual greenhouse gas emissions. With an EV you’d only need to plant 3.

- An ICE car’s life cycle produces emissions equal to 3 million smartphones.

- Driving an ICE car for a year is equal to the emissions generated from 63 garbage bags going into a landfill. For a BEV, the number is 0.

- 912 bulbs would need to be swapped to energy-saving LEDs to offset the greenhouse gas emissions an ICE vehicle produces over a lifetime.

Of those vehicles in the report, the Volkswagon Golf turned out to be the largest CO2 emitter at 165 grams per kilometer. The lowest emitting vehicles were all BEVs including the Nissan Leaf, BMW i3, Renault Zoe, and three Tesla models (the S, E, and X).

For ten years my wife and I drove a Mazda MPV, a minivan that in 2006 wowed us as state-of-the-art. But three years ago even though the vehicle was still in prime condition we decided to lease a Toyota RAV-4 Hybrid. I was gobsmacked by the changes that had occurred in a decade, particularly those related to vehicle safety. If I knew then that there was an aftermarket for my ten-year-old van, I might still be driving it today.

Enjoy Derek’s contribution and please, as always, join the conversation through your comments.

With many drivers choosing to hold onto their cars for longer, the average age of vehicles on the roads is increasing. This means that there are many ageing vehicles that lack the safety features available to newer models. As a result, there are billions of drivers around the world that are missing out on potentially life-saving technology.

Should You Upgrade Your Car or Upgrade Your Tech?

If you are concerned about the safety of your vehicle, then you can either purchase a newer one or upgrade the one you have with aftermarket add-ons. If your car is considered unsafe to drive, then upgrading to a newer model with essential safety features should be your only choice. But if the vehicle you own is still in good working order, the aftermarket for safety tech add-ons may be just for you.

The Benefits of Aftermarket Add-Ons

Recent innovations and decreasing prices are making the car safety aftermarket far more attractive for older vehicle owners. The majority of these add-ons are quite easy to install and fully compatible with smartphones. The added bonus of installing aftermarket safety options will help boost the resale value of the car should you decide to sell it.

Maybe You Need A Software Update?

Modern cars feature advanced computer systems that can be optimised through software updates. The updates are usually rolled out to tackle specific issues flagged by consumers, dealerships, or through manufacturers’ evaluations. If your car needs an update, then take it to a local mechanic for a tune-up.

Over-The-Air (OTA) software updates provide a cheaper and easier alternative to manual updates. Much like phone updates, these allow car manufacturers to send updated code to all cars of a specific make through wireless delivery.

Currently, Tesla is the only manufacturer that provides OTA updates allowing for improvements to be made quickly and easily. This may change, however, in the near future as international regulators consider a revision to the rules governing software updates on vehicles. Industry experts expect these changes to be implemented by 2021.

Learn More

If you are thinking about upgrading the safety features of your car, then check out the accompanying informative infographic produced by Hussey Fraser. It lists the ten best aftermarket add-ons to enhance the safety of older vehicles including parking sensors, HUD displays and much more.

The European market is still in the EV early stage. In 2018 Europeans could choose from 60 EV, plug-in hybrids, and fuel-cell models. In 2020 that number is expected to grow to 176. By 2021 it will be 214, and by 2025, 333. Around 60% of the total European EV production in 2025 will be battery-based. And this growth aligns with Europe’s carbon emission reduction goals over the same period.

Why is this happening in Europe at this time?

Transportation in Europe is the single largest contributor of airborne carbon on the continent amounting to 27% of total emissions. Of the 27%, 44% comes from automobiles with the number keeping on rising.

At the 2015 Paris Climate Agreement, the EU committed itself to net-zero emissions by 2050 and new-car sales to be net-zero by the mid-2030s. European manufacturers are required to reduce carbon emissions on new vehicle sales by 15% in 2025, and 37.5% in 2030.

EV sales in 2018 were relatively small in numbers accounting for 2.5% of the total European market. The top country, Norway (technically not an EU member) was responsible for 49% of EV sales. A distant second was Sweden at 8%, followed by the Netherlands, 6.7%, Finland, 4.7%, and Portugal, 3.4%.

Production, however, is ramping up with 2019 seeing three-quarters of a million built and sold. By 2025 the number is expected to grow to 4 million with a big decline in diesel-powered cars. The combined sales of diesel and gasoline-powered vehicles will decline by 2.7 million by that same year. Among domestic EU makers of EV cars will be Volvo, Volkswagen, BMW, and Daimler. Japanese, Korean, and Chinese EV carmakers, and some joint-ventures with European producers will make up the balance.

The EV cars built by European companies will largely stay in Europe. Why is that?

- Because EU carmakers and foreign companies producing them will need their entire production in the local market to meet carbon emission reduction benchmarks.

- Because exports will be inhibited by the lack of charging infrastructure in many non-EU countries.

What about battery capacity?

A potential inhibitor to achieving these forecasted volumes will be the production of lithium-ion battery packs. A recently formed European Battery Alliance has set a benchmark for manufacturing capacity with a goal of 131 Gigawatt-hours (GWh) by 2023, and 274 GWh by 2028. Comparisons with global capacity forecasts of 964.8 GWh in 2023 and 1,594 GWh by 2028 show that the EU will increase its world market share from 6.6% in 2019 to 1.7.2% by 2028. This will leave a capacity storage problem which will require European carmakers to rely on battery packs built in China. But by 2028 Europe will more than meet its battery pack capacity requirements for the EV cars it will produce. If you want to learn more please visit a detailed breakdown of Europe’s EV vehicle forecasts.

How does Europe compare with the rest of the planet?

American demand for EVs including hybrids is forecasted to rise to 1.28 million by 2026, a much smaller sales volume than Europe. The North American market will continue to be dominated by Tesla, the company that created the modern EV phenomenon. General Motors and Ford Motor Company will be distant competitors. But Tesla’s numbers are small. It sold 240,000 EVs in the global market in 2018 and expects to close this year with unit sales of between 360,000 and 400,000. On the battery pack side, capacity largely Tesla-built is expected to reach 130 GWh by 2023.

What’s holding America back and the spillover to Canada and Mexico, tied together by the North American automotive marketplace through a free trade agreement? It is the anti-climate change policies of the U.S. federal government that continues to support the status quo in the automotive industry, the internal combustion engine. In the last week the Democratic Party held a town hall event on climate change, and should one of the people running for president get to the White House in 2020, it is likely that North America will suddenly awaken to the EV market potential as the country tackles carbon emission reductions as a climate change mitigation policy.

The case of China, however, is quite different. The Chinese government is hell-bent on not putting many more diesel and gasoline-powered cars on its roads because of its smog-laden cities. In 2018, China recorded 1.1 million in EV and hybrid sales. Its 2019 forecast will surpass 2 million by year’s end. And by 2025 forecasters are estimating a market growth to 12.7 million EVs annually.

China’s battery pack capacity which reached 286 GWh last year is forecast to grow to just under 800 GWh by 2025, and 1,549 GWh by 2028. That will make China the largest manufacturer of battery packs on the planet and will allow them to meet domestic and foreign demand.

]]>

Currently, EVs displace the need for 350,000 barrels of oil each day. But over the long term, EVs are projected to disrupt demand by as much as 58,000,000 barrels per day— a figure that will steadily rise as EV costs plummet. EVs are set to win by sheer economic advantage, becoming the foundation for autonomous ride-sharing fleets in the future. As this happens, it will become uneconomical and societally unacceptable to continue to drive a gas-guzzling car.

The EV Competitive Advantage

This year, EVs are expected to surpass a 2.73% market share in the United States. They have already reached 5.4% in China. While this might seem small, growth is accelerating at an unprecedented rate, as the American EV market share projects to double every two years until 2025 and beyond. As explained by energy expert, science fiction writer, and engineer Ramez Naam, “Their growth rate is phenomenal. It took 20 years to sell the first million electric cars. It took 18 months to sell the next million. It took 4 months to sell the fifth million. That is the pace of this change. This is growing twice as fast as solar.” Stumping forecasters again, the surge is being driven by pure economics. While personal vehicles currently cost $0.80 US per mile, autonomous electric vehicles are expected to undercut this to only $0.35 per mile.

And even though EVs have been more expensive than gas and diesel-powered cars, EVs are turning out to be far cheaper to operate and maintain. The yearly cost to operate an EV today in the U.S. stands at about $485, less than half the $1,117 cost to operate a gas-powered vehicle. As battery prices continue to plummet, the upfront costs of EVs will decline until purchasing one will be a foregone conclusion.

The Growing Worldwide EV Race

Investment in EVs is booming today with auto manufacturers worldwide locked in an EV race.

Volkswagen is set to spend $50 billion on EVs in the next five years. Nissan is charging ahead with a vision to integrate its EVs into a broader consumer ecosystem through the company’s Intelligent Mobility strategy. And GM has pledged to go all-electric in the near future as it strives to release 20 new electric models in the next 4 years.

Beyond the car, EVs are disrupting large-scale shipping operations.

Last year, UPS ordered 950 N-GEN electric Workhorse Group vans, which can travel up to 100 miles on a single charge. At a cost of just $6 per 100 miles traveled, this trucking alternative promises astounding economic savings. While UPS currently operates 300 electric and 700 hybrid-electric vehicles, it aims to have 25% of its vehicles operating on alternative fuel by 2020. The company’s recent pre-order of 125 Tesla electric semi-trucks demonstrates yet another step towards this ambitious goal. The Tesla Semi today is expected to be 20% cheaper on a per mile basis to operate than fossil fuel-powered trucks and points to the extraordinary scale of the EV takeover, from compact cars to large-scale transit.

Electric Autonomy

Over the coming decade, market and environmental forces will lead to consumer adoption of EVs. And likely, the adoption of EVs will heavily feature autonomous fleets. And while personal EV adoption will continue to proliferate, the aggregate mileage of EVs will rise exponentially faster as autonomous electric ride-sharing fleets become commonplace.

McKinsey & Company, the global management consulting firm, predicts that one in ten cars sold could be a shared vehicle by 2030. Numerous leading car-share operators already employ EVs, such as Daimler’s Car2Go and BMW’s DriveNow programs. Meanwhile, most autonomous vehicle developers have included EV models in various of their testing phases.

A University of Texas study looked at autonomous taxis and determined at a cost of $0.75 per mile, over 39% of miles would be covered by these vehicles. And at half that price, $0.375 per mile, autonomous taxis would see coverage grow to 75% of total miles. Explains Ramez Naam, “the way that most people will first encounter an electric vehicle [won’t be a result of] buying one for themselves. These vehicles are [going to be] rapidly deployed mostly as electric taxis.”

Apple recently hired Tesla’s VP of Engineering, Michael Schwekutsch, indicating Apple’s intentions to wholly integrate EVs into its plans to develop autonomous vehicle technology. Just last year, Apple cars drove in autonomous mode for 80,000 miles, while drivers took back control of the vehicle for 1.1 miles driven on average. Increasingly competitive, driver intervention rates now stand nearly neck and neck with Mercedes-Benz’s human intervention rate of 1.5 miles, and Toyota’s somewhat higher reported average of 2.5 miles.

Another competitor, GM, covered 450,000 miles in the U.S. last year with its cutting-edge fleet of third-generation all-electric Chevrolet Bolt vehicles. The company currently operates Cruise Anywhere, an employee-only ride-hailing service in San Francisco, and has even partnered with DoorDash to leverage its vehicles for food delivery in the future.

One of the more salient figures in today’s EV surge, Tesla’s Elon Musk recently announced the company’s aspiration to release a fully autonomous robo-taxi fleet next year.

And one of the earliest players, Alphabet subsidiary Waymo, has risen far above any competitors in terms of miles driven and low human intervention rates. With 600 Waymo vehicles on the road, the company has driven over 16 million kilometers (10 million miles) in the U.S., not to mention an additional 12.8 million simulated kilometers (8 million miles) driven each day. Waymo vehicles at current rates require manual intervention only once every 17,700 kilometers (11,000 miles), vastly superior to the competition.

In December 2018, the company launched its Waymo One service, transporting more than 1,000 pre-vetted riders in the Phoenix area. Earlier this year, Waymo announced a strategic partnership with Jaguar Land Rover to release the I-Pace, a fully electric autonomous SUV. The plan is to release 20,000 vehicles by 2020.

Final Thoughts

As electric vehicles improve in performance and witness a drop in overall operating costs, forward-thinking individuals, companies, and investors are rapidly transitioning to all-electric transport. With the help of increased battery technology efficiency, tomorrow’s EVs will see a unit price drop that will make these vehicles more affordable while providing huge environmental benefits.

As 5G and next-generation cellular networks make autonomous vehicles a reality, it will lead to a growth in driverless EV fleets, with partnerships between EV manufacturers, autonomous driving companies, and ride-sharing services becoming increasingly vital.

The disruption to our existing car world will be significant as plummeting prices, and increasing convenience will tip in favor of EVs and cars-as-a-service. Private ownership of internal combustion engine cars will become a thing of the past.

Editor’s Note

The lack of mention of hydrogen as a fuel, and hydrogen-fuel-cell technology and their use to power vehicles seems to be an oversight on the part of Diamandis. Particularly in rural areas, where a minimal charging infrastructure and long-distance commutes will require alternatives to EVs, there will remain a need for hydrogen zero-emission technology or even a few diesel and gasoline-powered vehicles.

An Airbus for batteries operation

Germany and France have a history of success in joining forces to tackle a growth industry. Airbus, the rival to Boeing today, was formed through a similar consortium.

The hope is to duplicate that success in four to five years.

The two countries have pledged 4 billion Euros ($4.5 billion US) coming from 35 automakers and energy groups which have indicated their intention to partner in the alliance. The European Union is adding 1.2 billion ($1.3 billion US) in the form of a public subsidy to support the new venture.

The first pilot factory will open in France in the next few months empllying 200. Additional production sites in France and Germany are planned for 2023 with each employing 1,500.

What is Europe’s current market share in EV batteries?

Today Europe produces 1% of the world’s lithium-ion batteries. And yet the major automobile manufacturers in Europe have all announced aggressive strategies to laucnh a number of new EV models annually. Where will the batteries come from? Not Europe currently.

But if the consortium succeeds, the goal is to have Europe supply 30% of global demand by 2027.

Other European countries are interested in joining the consortium including Italy, Belgium, Poland, Austria, and Finland with the market for EV batteries expected to grow to 45 billion Euros (more than $50 billion US) by 2027.

So who currently leads in producing EV batteries?

Today it is Tesla and Panasonic that are number one ranked. But Chinese companies are quickly catching up. According to Benchmark Minerals, the growth in Chinese lithium-ion capacity is expected to produce batteries sufficient to rollout 15 million EVs annually by 2023, 18 million by 2025, and 23 million by 2028.

For Europe to achieve 30% of worldwide lithium-ion battery production will involve more than the current investment mentioned in today’s announcement.

Is there enough raw material to feed the EV market?

The biggest constraint on EV growth is the availability of the raw materials to build batteries. EV batteries produced today consume 46% of the world’s annually produced cobalt, and 32% of the mined lithium. The average Nissan Leaf battery, for example contains 4 kilograms (9 pounds) of lithium. If every car on the planet were to be an EV, the current amount of raw materials, particularly lithium, would not meet the demand.

Lithium recycling capacity may make it possible to reuse existing lithium from batteries for second use. Experts estimate that for every 20 tons of used lithium, 1 ton can be harvested for use in new batteries.

Potential shortages may be further alleviated by new lithium and cobalt sources such as the ones going into production in Western Australia.

And at the same time, new battery technologies may displace lithium and cobalt as the primary materials for EV batteries.

]]>

California has a reputation for embracing new technologies, especially evident in its policy towards self-driving vehicles. One of those technologies that has received approval is Silicon Valley-based Zoox, founded in 2014. The state has granted the company not only the right to test its technology on public roads, but also to transport passengers in its vehicles. This is a first for California.

Who is Zoox?

Zoox is building a 100% autonomous vehicle transportation service with a focus on passengers, not drivers. Their vehicles have no “front” or “back.” There is no steering wheel. Built specifically for safety, Zoox is focused on eliminating the human factor in driving and therefore, accidents.

With the California approval, Zoox is now expanding its operations from allowing only its employees and family members on its vehicles, to the general public. The company wants to hear from Californian commuters so that it can improve its self-driving technology.

Zoox is committed to sustainability, and therefore, all of its vehicles are zero emission.

Zoox Services Will Have Stipulations for Now

Before the company can achieve an absolutely autonomous vehicle service, California is requiring that at least one trained driver be onboard just in case of an emergency. The agreement also stipulates that the current operation of Zoox vehicles will be free to anyone who chooses to go for a ride in one of its vehicles. These restrictions fall in line with California’s Drivered AV Passenger Service pilot program, which lawmakers approved in May of 2018. Officially listed as Decision 18-05-043, the main requirement stipulates a physical driver on board at all times.

Along with this pilot, California has also issued a second called the Driverless AV Passenger Service program which could allow companies like Zoox to send their vehicles out without a physical driver on board. Under this California pilot, the DMV requires the company to have employees constantly monitor their vehicles from secured locations. In addition, every vehicle must include a way for passengers to get in touch with the employees who are tracking the vehicle. Although no Zoox vehicles have been given the green light to operate this second pilot, it is likely that Zoox will be the first to be granted this privilege, all things going well.

Who is the Competition?

Zoox is just one of 62 autonomous vehicle companies operating in California. But one, in particular, stands out as a prime competitor. That is Waymo, a subsidiary of Alphabet that started in 2009. Waymo has been testing its autonomous vehicles without drivers in many California cities, but to-date they are not allowed to pick up passengers.

Waymo, however, has been operating with greater freedom in Arizona. Just recently, it announced that customers in Phoenix could pay a fare to use its self-driving vehicles. While many Waymo vehicles have a human driver on board, a few now are driverless. Testing has been ongoing for several months.

Autonomous Vehicle Safety Issues

When discussing the pros and cons of autonomous vehicles, critics most often question safety standards. It’s no wonder this is an issue since the press seems to cover any autonomous vehicle crash turning these rare occurrences into global headlines. The latest occurred in Tempe, Arizona, when an Uber’s self-driving vehicle fatally struck a pedestrian during a test-run. After this tragic accident, Arizona’s Governor ordered Uber to stop testing its self-driving vehicles on public streets.

As of today, there is no clear evidence to indicate that autonomous vehicles are safer than those operated by human drivers. The sample is far too small. Only putting more autonomous vehicles on the road both with and without a human driver will produce enough data to better understand the technology’s safety issues.

In the meantime, many who are technology savvy have suggested research into engineering ethics to address public fears. Through the specifying of autonomous vehicle behavior acceptable to the public, it will help companies like Zoox and Waymo to improve on their self-driving algorithms.

Other Issues Facing The Industry

Safety concerns will always be the most significant issue surrounding autonomous vehicle technology. But there are other challenges. For instance, vehicle accident attorneys are grappling with changing the laws governing accidents to account for this technology. With different degrees of autonomy in most self-driving vehicles, lawyers are trying to figure out how much liability should be assigned to drivers or manufacturers in the event of a crash.

There’s also a concern that autonomous vehicles cause significant changes to the automotive industry. The growth of the sharing economy, some economists believe, will make autonomous vehicles more attractive to ride-share companies than to private consumers. To increase safety and reduce both traffic and emissions, it’s more likely that self-driving vehicles will be operated as fleets owned by the manufacturers, or by transportation businesses rather than be purchased by individuals. If this comes to pass then car dealerships and the service industry that is currently the business model around the world will drastically change. That means dramatic disruptions to post-vehicle manufacturing jobs. On the flipside, a shift to shared autonomous vehicles will mean more people will be spending time looking at screens while in transit, and that may prove a boon to advertisers.

California’s DMV Standards For Driverless Vehicles

To address some of these issues, CA DMV has been formulating autonomous driving regulations since the beginning of 2013. Currently, there are three different tests to which autonomous vehicle companies can apply: testing permits with a driver, driverless testing permits, and public use permits. You can learn more about these at the California DMV website. The full text of the California autonomous vehicle regulations is available at California Vehicle Code Section 38750. And for a list of current autonomous vehicle permit-holders, check out the official webpage.

]]>

Mapillary can be integrated into almost any tool, application or website. It connects to the most popular geographic information systems (GIS) through integration with ArcGIS, OpenStreetMap, and HERE Map Creator. Mapillary co-founder, Jan Erik Solem, a mathematician by training, describes the difference between his product and Google Maps and Street View, as a mapping system that doesn’t need a camera-equipped vehicle out on the road constantly refreshing the centralized image database.

Instead, Mapillary involves individuals, institutions, and companies to contribute images that can be immediately incorporated into online maps. For navigation systems, the difference between a Google Streetview and Mapillary would be immediately notable when road conditions suddenly change, a sudden storm, a flash flood, powerlines down or a fallen tree, all likely to make a street impassable.

The collaborative model is Mapillary’s unique value proposition. The question is can the company sell it to automotive developers building navigations systems for their models, and eventually for autonomous vehicles. The ability to produce maps and digital images of hazards happening in real-time will make self-driving vehicles more reliable.

To publish street-level imagery and accurate maps, the application imports and renders the data it collects using computer vision and machine learning technologies. As more images get shared the maps automatically update creating real-time, street-level views. Images and data can be extracted by time and by objects within the images which are then visually displayed on maps.

Currently, Mapillary is adding hundreds of thousands of images daily from volunteer contributors all over the world helping it to build a global cloud map of all major roads on Earth.

The application automatically detects 65 classes of objects including:

| Curb Fence Guard rail Barrier (other) Lane separator Wall Bike lane Crosswalk (basic) Curb cut Parking Pedestrian area Rail track Road Road shoulder Service lane Sidewalk Traffic island Bridge Building Garage Tunnel Person |

Lane marking (dashed) Lane marking (solid) Crosswalk (zebra) Lane marking (other) Lane marking (stop line) Lane marking (text) Sky Snow Lawn Trees Water Banner Bench Bike rack Billboard Catch basin Fire hydrant Junction box Mailbox Manhole Parking meter Pothole |

Streetlight Pole (generic) Traffic sign frame Utility pole Traffic cone Traffic light Traffic sign Construction sign Trash can Bicycle Boat Bus Car Caravan Motorcycle Train Vehicle (other) Trailer Truck Wheeled slow vehicle Wire group |

The computer vision visualizes everything and places these objects in real-time on maps.

Besides all these objects the application detects and differentiates among 1,500 types of traffic signs from 100 countries.

To become a Mapillary contributor you just have to sign up and start sending them pictures of your streets. The company sponsors mapathons and Maptime events to spread the word. Companies, utilities, and governments can open a Mapillary account and begin building cloud-based maps.

]]>

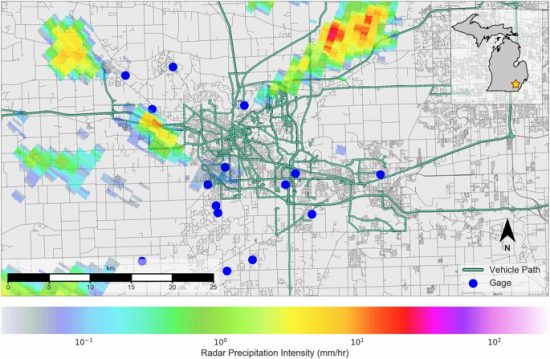

Based on the analysis of 70 connected vehicles and their windshield wipers, they have produced a data set that provides accurate methods of measuring precipitation including the timing, location, and amounts surpassing traditional weather gauges. In their conclusions, they note that wiper measurements are stronger predictors of rainfall measurement that get missed by stationary gauges. And they propose that this method of data gathering would enhance rainfall maps “to improve flood warnings and facilitate real-time operation of stormwater infrastructure.”

The problem the authors are attempting to address is urban flash floods. Flash floods are today the number one cause of fatalities from natural disasters worldwide. The lack of accurate real-time data to forecast a potential flash flood occurrence to provide a window of safety between one and 15 minutes could be facilitated by measuring what falls on car windshields using the wipers.

The confluence of the rise of connected and autonomous vehicles represents an unprecedented opportunity for doing this type of real-time precision precipitation measurement. In the paper the authors write:

“Windshield wiper activity offers a novel means to detect the location and timing of rainfall with enhanced precision. When used in conjunction with modern signal processing techniques, wiper-based sensing offers several attractive properties: (i) vehicles achieve vastly improved coverage of urban areas, where flood monitoring is important; (ii) windshield wiper intensity is easy to measure and requires little overhead for processing (as opposed to video or audio data); and (iii) vehicle-based sensing can be readily scaled as vehicle-to-infrastructure communication becomes more widespread.”

They go on describing how many new vehicles use optical rain sensors to activate windshield wipers. My 2017 Toyota RAV4 is one of these. I never turn on the windshield wipers because they go on automatically when they detect rain and then increase their frequency of swipes as the rain intensifies. That’s because the optical rain sensors have the ability to directly measure rain intensity. Collecting the data produced by these sensors can provide accurate measurements of precipitation by locality.

In comparing stationary weather gauge precipitation collection, radar, and windshield wiper measurements for three storm events the authors conclude that the latter produced the most accurate measure of a rainfall event detecting even “intermittent changes in rainfall…on the order of seconds” when compared to radar and gauge measurements which provided data reporting in 5-minute increments.

The authors aren’t proposing that radar and weather gauge methods of measuring precipitation be scrapped. Rather they believe that including vehicle-based measurements in the arsenal of forecasting tools will produce much more meaningful data in real-time. And in the event of a rainfall event that produces a flash flood, seconds may count whereas minutes may not provide a fast enough forecast for people to stay off thoroughfares where flooding is imminent, and away from stormwater channels and rivers that may suddenly crest.

]]>

In 2017, Shenzhen’s bus network of 16,000 vehicles went electric. The move meant annual carbon emission reductions of 440,000 tons. It was one of 13 cities invested in promoting alternative energy public transport. But with the taxicab fleet now going electric, it means that Shenzhen’s carbon emissions now will decrease by 850,000 tons per year, a 48% cut in airborne pollution.

The all-electric transit initiative doesn’t include Uber-like ride-hailing vehicles which remain on the city’s streets and are still popular with residents.

How can Shenzhen support so many electric vehicles? An electric vehicle infrastructure of more than 20,000 public charging stations is in place making it possible for the entire fleet of electric taxicabs to stay on the road. The buses have their own charging infrastructure with 180 depots able to accommodate up to 20 buses at a time allowing them to travel 200 kilometers per day, more than sufficient to handle their routes.

To improve the efficiency of the fleet, each taxicab is equipped with data terminals that do route planning and optimize the distribution of vehicles to make sure they are in place where passenger demand is greatest at all times.

The greenhouse gas emissions produced by the transportation sector represent a significant part of the pollution that Shenzhen experiences throughout much of the year with numerous smog days from suspended nitrogen oxides, carbon dioxide, and particulate matter. Some of these emissions come from coal-fired thermal power plants, but cars, trucks, and buses play a significant role.

An unintended bonus for the city is noise reduction. With electric vehicles replacing gasoline and diesel-powered cars and buses, Shenzhen’s streets are becoming a lot quieter. In fact so quiet that the bus authority has been receiving complaints requesting it add artificial noise to its fleet because people are unaware of the buses at times if they don’t see them coming.

How has Shenzhen been able to afford to go electric? Much of the cost is being subsidized by China’s central government which plans to end its assistance program by 2020. That’s why more than 30 other cities in China have accelerated plans to go 100% electric for bus transit within the next two years. Among these are Guangzhou, Zhuhai, Dongguan, Foshan, Zhongshan, Nanjing, Hangzhou, Shaanxi, and Shandong, representing urban areas with a population exceeding 300 million.

]]>